You can use an SBI home loan calculator to find out how much you need to borrow for buying a house. There are many factors that you will need to consider, including Interest rate, tenure of the loan, amount of the loan, and Online payment option. Using this tool will help you find the best deal for your financial situation.

Interest rate

SBI home loan interest rate starts at 8.05% per annum. There are 24000 branches of SBI throughout India. You can choose a fixed or floating rate for a loan that suits your budget and repayment capacity. Your credit score is an important factor in determining which rate and tenure is right for you. Also, keep in mind that a higher interest rate will result in higher monthly instalments.

Regular home loans are available to those with a credit score between one and six hundred. This is a 15 basis point discount compared to the normal rate of 8.75%. You can also get an unsecured loan if you are not earning a monthly salary. This loan is available for new residential units, construction, repair, renovation, and transferring a loan from another bank. The loan amount may range between Rs. 50 lakhs and 50 crores.

Loan tenure

Using the SBI home loan tenure calculator, you can calculate the amount of EMI you will need to pay for a given tenure. The EMI will include the principal repayment and the interest component. The longer your loan tenure, the less interest you will have to pay. The SBI home loan tenure calculator is a useful tool to determine the best home loan tenure for your needs.

SBI offers both online and offline banking services. If you do not wish to use the online banking service, you can visit any branch of the bank and submit the required documents. Once you have all the documents ready, complete the application form and submit it to the bank official. Alternatively, you can apply online by filling up a form on their website. When you fill the form, you are required to provide your contact details so that a bank representative can call you back and discuss your loan requirements.

Loan amount

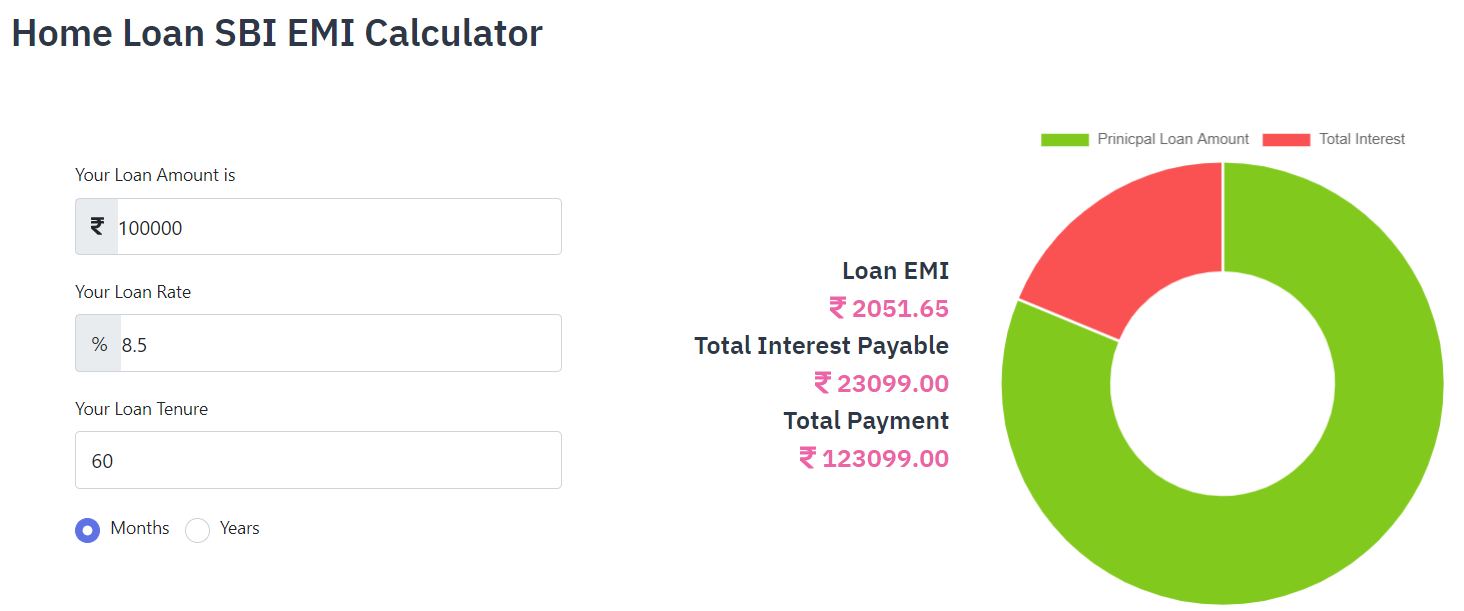

The SBI Home loan calculator is a useful tool to help you calculate the loan amount you need to purchase a home. It is free to use and can be found on the official SBI website. Using this calculator is simple and convenient, and you can use it to determine your loan amount and EMIs in just a few minutes. All you need to do is enter the loan amount and interest rate into the calculator and click on “Calculate”. It will then calculate the loan amount and EMI that you need to repay. The calculator can be used from any computer or mobile device.

SBI Home loan calculator also offers an excel version for users to input their data. The calculator offers prepayment and EMI options and provides a chart to help visualize the data.

Online payment option

The SBI Home loan calculator is a useful tool to use if you’re planning to purchase a home. It can provide you with an instalment schedule that breaks down each payment into principal and interest. You can enter the amount you plan to borrow, interest rate and tenure of your loan to calculate your monthly instalment payment. The calculator can also be adjusted manually.

When you use SBI home loan calculator, you can enter the amount you want to borrow as the loan amount. Then, it will calculate the EMI over different tenures. You can choose five-year, ten-year, fifteen-year, or thirty-year tenures. The calculator will show you how much each EMI would be over each period. The amount you will borrow can be anywhere from Rs. 15 lakhs to ten crores.

Credit score requirement

When applying for a home loan, it is important to have a good credit score. SBI requires a minimum credit score of 650. While a higher score is desirable, you may still be able to qualify for a home loan with a lower score. There are other ways to improve your credit score.

SBI offers several different types of home loan. Its rates are determined by your CIBIL Score and internal credit rating. A good score will lower your interest rate and make it easier to qualify for the loan. It will also make other SBI credit facilities more accessible to you. So, it is a good idea to periodically review your credit report and make any necessary corrections.

Another way to improve your credit score is to take advantage of CIBIL’s monthly credit report service. This service will let you check your credit score for free. You can also choose to receive periodic checks for a small fee. Credit scores are a major factor in the approval of loans, so it is important to keep them up-to-date.